|

17.03.2025 11:39:05

|

AMINA Bank: Stablecoins: Key Developments and Future Catalysts

In this edition of the Crypto Market Monitor, we explore the latest stablecoin market developments, the key players driving innovation, and what’s next for this rapidly expanding sector.

The Why

Throughout history, stable forms of value have been essential for enabling trade. Consider the international gold standard, which emerged in the 1870s and built global trust in money until it was abandoned in 1971. Gold provided a benchmark for newer, less stable currencies, helping them gain acceptance. The U.S. dollar, for instance, was once backed by gold - a key factor in its rise as the world’s most widely held reserve currency.

Fast forward to today, and the crypto market is teeming with thousands of digital currencies. At the time of writing, approximately 17,000 active cryptocurrencies are trading across 1,281 exchanges, with hundreds of new tokens launching daily. However, the market is notorious for its volatility. While trading these assets directly against traditional fiat currencies would be ideal, the infrastructure to support seamless crypto-to-fiat conversions is still evolving. Some banks and exchanges are developing solutions, but widespread adoption remains a work in progress.

This is where stablecoins come in. These cryptocurrencies are pegged to the value of traditional fiat currencies, providing a steady reference point in an otherwise turbulent market. For example, USD Coin (USDC), issued by Circle, is tied to the U.S. dollar and generally maintains a $1, assuming a well-functioning market.In times of extreme liquidity shortages or panic trading, minor deviations from the peg can occur. Other widely used stablecoins include Tether’s USDT, Maker’s DAI, and Ethena’s USDe. Currently, more than 260 stablecoins are actively traded.

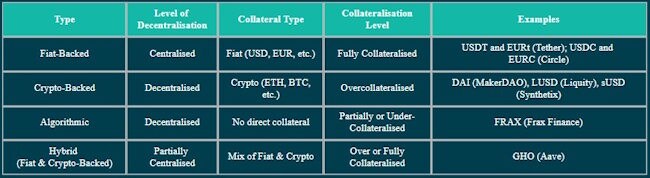

Figure 1 illustrates the different types of stablecoins based on their reserve backing structure, level of decentralization, and peg mechanism.

Figure 1: Different categorisations of stablecoins

Source: AMINA Bank AG, March 2025.

The current state of the stablecoin market

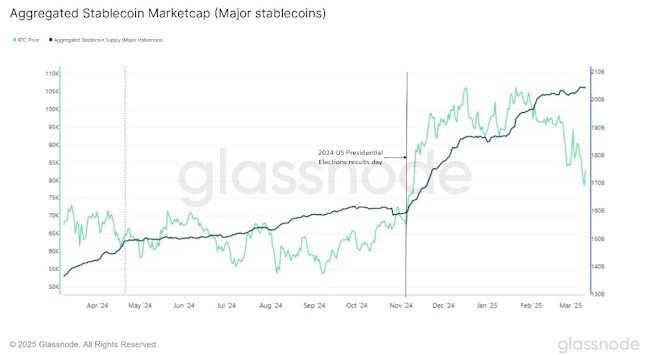

The stablecoin market continues to expand, with total market capitalization currently hovering around $227 billion. Notably, the combined market cap of the top five stablecoins USDT, USDC, BUSD, DAI, and TUSD, surpassed $200 billion for the first time last month. This recent surge in stablecoin supply appears to be linked to broader macroeconomic and political events. In particular, market data indicates a sharp increase in total stablecoin issuance following the results of the U.S. Presidential election in November 2024.

Figure 2: Crypto stablecoin marketcap witnessed a sudden leap in November 2024 following the results of the US Presidential election.

Source: Glassnode (12 March 2025)

This surge in supply was just the beginning of a larger transformation in the stablecoin market. Over the past month, on-chain stablecoin transaction volumes have increased by 18.5%, signaling growing adoption. With daily average stablecoin transaction volume around $100 billion and the number of unique addresses engaged in stablecoin-related activities hovering around 2 million, the sector is undergoing a series of seismic shifts.

These shifts are being driven by new stablecoin launches, strategic acquisitions, and favorable regulatory developments, all of which are shaping the next phase of stablecoin adoption and utility.

Recent Developments

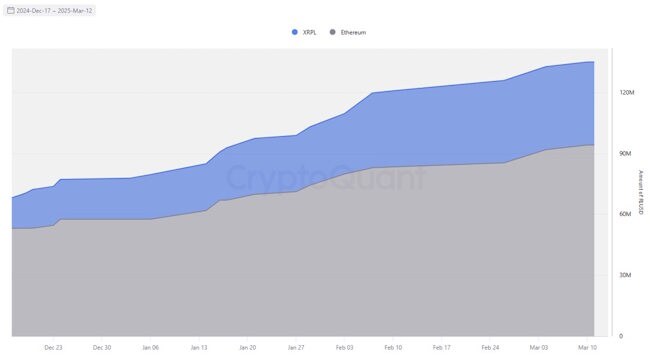

In the recent past, the first major announcement from the stablecoin sector came in the form of Ripple announcing the listing of their native stablecoin - RLUSD. Ripple’s announcement of RLUSD following approvals by the New York Department of Financial Services has strongly encouraged stablecoin-related activity in the United States. At the time of preparing this article, RLUSD has a circulating supply of close to 135 million, with 94 million of this on Ethereum and close to 41 million on the XRP Ledger. The stablecoin’s cumulative transaction count has exceeded the 400K mark.

Figure 3: RLUSD Circulating Supply

Source: CryptoQuant (12 March 2025)

Parallelly, regulators have also been reshaping the stablecoin market, setting the stage for broader adoption. In Europe, Markets in Crypto Assets ("MiCA") regulations have driven changes in the EUR stablecoin market. The European Union has approved a total of 10 stablecoin issuers under its new stablecoin regulatory framework including the likes of USDC’s Circle and Societe Generale (issuer of the EURCV stablecoin). Tether - the issuer of the world’s largest stablecoin by market cap, USDT - was not on the list. The other approved firms include Banking Circle, Crypto.com, Fiat Republic, Membrane Finance, Quantoz Payments, Schuman Financial, StabIR and Stable Mint.

The latest development in Thailand too is a push for global crypto adoption. Thailand’s Securities and Exchange Commission ("SEC") announced a decision to add Tether’s USDT and Circle’s USDC to its list of approved cryptocurrencies for trading on digital asset exchanges.

Even traditional players have taken a keen interest in stablecoins. Last month, payments giant Stripe completed its $1.1 billion acquisition of the stablecoin platform Bridge that builds APIs for accepting stablecoin payments. Ethena - developer of the USDe stablecoin - raised $100 million to finance iUSDe - a token targeted at traditional financial institutions. Tradfi giants Franklin Templeton and Fidelity Investments' F-Prime Capital were among the backers.

Upcoming Catalysts

The market is also anticipating positive regulatory developments going forward and a resulting boost in activity for the sector. Previously during the White House Crypto Summit on March 7, US Treasury Secretary Scott Bessent said the American government would use stablecoins to ensure the US dollar remains the world’s global reserve currency. As a move towards this vision, the US Senate voted on the Genius Act - a stablecoin bill that would introduce regulations similar to those for traditional financial institutions - which potentially will encourage institutional participation.

While this plan is centered around the dollar rather than directly boosting the crypto stablecoin sector, meaningful regulatory changes are needed to make it a reality. If implemented, these changes could make stablecoins a far more appealing option for US institutions. The market is already gearing up for a new US-based stablecoin issuer, especially after the Bank of America CEO hinted that the bank could launch its own stablecoin - if Congress gives the green light. That makes this bill one to watch, as it could shake up the US stablecoin market and ramp up competition even further.

Beyond the constraints of regulation and the dominance of major players in the US, there’s an exciting development happening on-chain. Aave, the largest lending protocol by market cap, is exploring the launch of sGHO - a savings-focused version of its native stablecoin, GHO. The goal is to boost adoption, building on its current supply of 203 million and a holder base of 3,260.

Conclusion

The stablecoin market is thriving. As demand for digital dollars soars, stablecoins are proving to be one of crypto’s most profitable sectors. Institutions are taking notice and regulators are slowly waking up to their importance. The ability to move value across borders instantly is a game-changer.

But beyond their utility, stablecoins are also a gold mine for issuers. Tether, for example, reported a staggering $13 billion in profits in 2024. And it's not just about profits: the issuer has also committed to putting 15% of its net earnings into Bitcoin - a move that will further crypto’s position in the global financial system. It already holds the sixth-largest BTC wallet, proving that stablecoins are not just a bridge to traditional finance but also a catalyst for crypto adoption.

With capital flowing in and competition heating up, the sector is only getting stronger. Whether through payments or DeFi, stablecoins are quietly reshaping global finance.

Disclaimer - Research

This document has been prepared by AMINA Bank AG ("AMINA") in Switzerland. AMINA is a Swiss bank and securities dealer with its head office and legal domicile in Switzerland. It is authorized and regulated by the Swiss Financial Market Supervisory Authority (FINMA).

This document is published solely for educational purposes; it is not an advertisement nor is it a solicitation or an offer to buy or sell any financial investment or to participate in any particular investment strategy. This document is for distribution only under such circumstances as may be permitted by applicable law. It is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or would subject AMINA to any registration or licensing requirement within such jurisdiction.

No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained in this document, except with respect to information concerning AMINA. The information is not intended to be a complete statement or summary of the financial investments, markets or developments referred to in the document. AMINA does not undertake to update or keep current the information. Any statements contained in this document attributed to a third party represent AMINA's interpretation of the data, information and/or opinions provided by that third party either publicly or through a subscription service, and such use and interpretation have not been reviewed by the third party.

Any prices stated in this document are for information purposes only and do not represent valuations for individual investments. There is no representation that any transaction can or could have been affected at those prices, and any price(s) do not necessarily reflect AMINA’s internal books and records or theoretical model-based valuations and may be based on certain assumptions. Different assumptions by AMINA or any other source may yield substantially different results.

Nothing in this document constitutes a representation that any investment strategy or investment is suitable or appropriate to an investor’s individual circumstances or otherwise constitutes a personal recommendation. Investments involve risks, and investors should exercise prudence and their own judgment in making their investment decisions. Financial investments described in the document may not be eligible for sale in all jurisdictions or to certain categories of investors. Certain services and products are subject to legal restrictions and cannot be offered on an unrestricted basis to certain investors. Recipients are therefore asked to consult the restrictions relating to investments, products or services for further information. Furthermore, recipients may consult their legal/tax advisors should they require any clarifications.

At any time, investment decisions (including whether to buy, sell or hold investments) made by AMINA and its employees may differ from or be contrary to the opinions expressed in AMINA research publications.

This document may not be reproduced, or copies circulated without prior authority of AMINA. Unless otherwise agreed in writing AMINA expressly prohibits the distribution and transfer of this document to third parties for any reason. AMINA accepts no liability whatsoever for any claims or lawsuits from any third parties arising from the use or distribution of this document.

Research will initiate, update and cease coverage solely at the discretion of AMINA. The information contained in this document is based on numerous assumptions. Different assumptions could result in materially different results. AMINA may use research input provided by analysts employed by its affiliate B&B Analytics Private Limited, Mumbai. The analyst(s) responsible for the preparation of this document may interact with trading desk personnel, sales personnel and other parties for the purpose of gathering, applying and interpreting market information. The compensation of the analyst who prepared this document is determined exclusively by AMINA.

BITCOIN KAUFEN? DAS SOLLTEN SIE JETZT WISSEN!

Was beim Einstieg wirklich zählt: Sichere Handelsplätze finden, wichtige Grundlagen und aktuelle Trends verstehen.

Jetzt informieren und fundiert in Bitcoin investierenTop Kryptowährungen

| Bitcoin | 75’706.98993 | -4.28% | Handeln |

| Vision | 0.06279 | 1.24% | Handeln |

| Ethereum | 2’519.92629 | -1.83% | Handeln |

| Ripple | 1.80837 | -2.32% | Handeln |

| Solana | 112.17178 | -2.67% | Handeln |

| Cardano | 0.40207 | -4.61% | Handeln |

| Polkadot | 2.27918 | 0.38% | Handeln |

| Chainlink | 11.16590 | -3.57% | Handeln |

| Pepe | 0.00000 | -7.74% | Handeln |

| Bonk | 0.00001 | -3.42% | Handeln |

Inside Krypto

Ob Industrie 4.0, Luxusgüter oder Internet-Infrastruktur - hier finden Sie aktuelle Anlagetrends mit vielen Hintergrundinformationen und passenden Trendaktien. Jetzt mehr lesen

Börsentag 2025: Silber vor Verdopplung? Rohstoffexperte über die Chancen

Im Experteninterview erklärt Prof. Dr. Torsten Dennin, welche Faktoren die Preise von Gold, Silber, Kupfer, Uran und Agrarrohstoffen treiben – und welche Chancen & Risiken Anleger jetzt kennen sollten.

👉 Was steckt hinter der aktuellen Gold- und Silber-Rallye?

👉 Welche Rohstoffe gelten 2025 als besonders spannend für Investments?

👉 Wie investieren Anlegerinnen und Anleger am besten in Edelmetalle & Rohstoffe?

Erhalte fundierte Einschätzungen, Marktprognosen und Antworten auf spannende Zuschauerfragen rund um Edelmetalle, Minenaktien, ETFs und Rohstofftrends.

👉🏽 Jetzt auch auf BXplus anmelden und von exklusiven Inhalten rund um Investment & Trading profitieren!